Starting January 2022, 6000 public interest companies are required to indicate whether their economic activities are eligible for the EU Taxonomy. Since its initial publication in mid-2020, the EU Taxonomy has been generating a lot of interest from companies and individuals alike. But what exactly is the EU Taxonomy? Why has it been created, and why now? And what implications will it have for your company?

Do our EU Taxonomy scan to find out what the EU Taxonomy will mean for youFor 13 sectors, the EU Taxonomy has published criteria on what makes an economic activity sustainable. Is your organization in one of these sectors and would you like to know what this means for you? Fill out this survey and get a head start on discovering the requirements of the EU Taxonomy for the activities of your company. |

Why has the EU Taxonomy been created now?

There are two major factors that have driven the development of the EU Taxonomy: the EU Green Deal and the Covid-19 pandemic.

Firstly, the EU Taxonomy is a direct consequence of the European Green Deal. The Green Deal was presented in December 2019 and has, among others, set a target for the European Union to be carbon neutral by 2050. To accomplish this monumental task, a whole range of initiatives is needed.

Additionally, the Covid-19 pandemic has spotlighted (the lack of) resilience of companies, cities, and countries. Companies and public officials worldwide have realized that resilience must be increased to absorb future shocks to their systems. One part of becoming resilient is by investing in sustainable initiatives.

The European Commission has set multiple programs in motion to achieve both goals, one of which is the EU action plan on financing sustainable growth. This action plan consists of numerous objectives, but one key objective is the call for a common language and definitions in the field of sustainable financing. In other words, a taxonomy.

Why is the EU Taxonomy needed?

While investments in sustainable technologies and businesses have been on the rise, the need remains to direct much more investment towards such initiatives. To meet the EU’s targets for 2030, an estimated 350 billion Euro per year extra is needed in sustainable investment compared to the previous decade. The goal of the EU Taxonomy is to help close that investment gap.

The taxonomy aims to accomplish this through a multitude of ways:

Firstly, it will promote and facilitate sustainable investment by clearly indicating which businesses, technologies, and financial products are sustainable.

Secondly, providing these definitions creates a common language in the field of sustainable finance, an area that often still suffers from ambiguity and various indicators that are used almost interchangeably. While the EU taxonomy will only be legally binding in the European Union, expectations are that its definitions will be used much more widely and thus, its effect felt globally.

Thirdly, it will provide customer protection against greenwashing. If an investor wants to invest in sustainable companies, they can check whether the companies are aligned with the EU Taxonomy, regardless of their marketing message.

Lastly, it provides companies with guidelines on becoming sustainable. Following the guidelines to become taxonomy-aligned creates confidence for internal and external stakeholders that the company contributes to a sustainable future.

How does the EU Taxonomy work?

At the basis, the EU Taxonomy is a classification system for economic activity. This means that the purpose of the taxonomy is to create a comprehensive list of economic activities that are deemed environmentally sustainable. It also creates one set of definitions with which investors and companies alike can work.

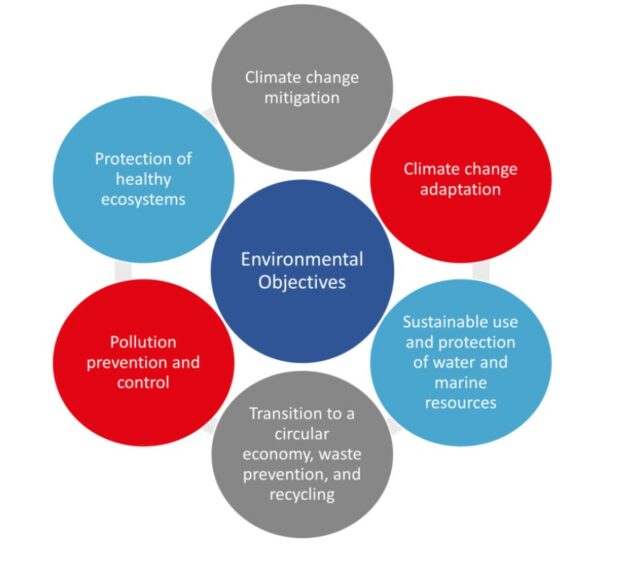

The taxonomy uses six overarching environmental objectives:

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of water and marine resources

- Transition to a circular economy, waste prevention, and recycling

- Pollution prevention and control

- Protection of healthy ecosystems

Then, for an activity to be considered sustainable, it must meet four criteria:

- It must make a significant contribution to at least one environmental objective

- It must do no significant harm to any environmental objective

- It is carried out in compliance with minimum safeguards – OECD Guidelines for multinational enterprises and UN guiding principles on business and human rights

- It complies with technical screening criteria – These are sector/activity-specific and laid out in delegated acts

The timelines of the EU Taxonomy

The EU Taxonomy will come into effect in multiple phases. The first phase occurred in mid-2020 when the Taxonomy regulation was published by the European Commission and entered into force in July 2020. The taxonomy regulation set out the six overarching environmental objectives mentioned earlier and the four criteria that any economic activity must meet to qualify as environmentally sustainable.

Then, in line with the technical screening criteria, documents called delegated acts are published. These delegated acts contain the actual list of economic activities considered sustainable and under what criteria. The first such act was published in April 2021 and covers the climate mitigation and adaptation objectives. The second act will cover the other four objectives and will be published in 2022. The first delegated act does not cover all industries (yet); however, it currently covers approximately 40% of companies in the EU, responsible for an estimated 80% of greenhouse gas emissions.

Is the EU Taxonomy mandatory for your company?

While everyone can use the EU Taxonomy to measure their own progress and sustainability performance, it will be legally required for approximately 6000 public interest companies as well as financial institutions that offer investment products. The vast majority of the companies required to do so are already covered by the non-financial reporting directive (NFRD).

Starting January 2022, these companies must indicate to what extent their economic activities are eligible for the EU Taxonomy. Then in 2023 they should also indicate what proportion of their economic activities are aligned with the EU Taxonomy. Financial institutions then follow in 2024 when they must indicate to what extent their financial products (such as investment funds) are aligned with the taxonomy. Please note that it is not mandatory to be fully aligned yet; you have to indicate which of your activities are aligned and which are not. Is your company not currently covered by the EU Taxonomy? Even then, it can still be valuable to start measuring yourself against its guidelines. Not only do you protect yourself from a future expansion of the EU Taxonomy, but it also provides valuable insight into how much of your economic activity is sustainable and what steps to take if they are not. Furthermore, being transparent on this topic signals to both internal and external stakeholders that you are taking environmental sustainability seriously.

Where to start with the EU Taxonomy

While the first delegated act can be read in full (200 pages) or in an Excel file that shows all activities, perhaps the best way to get an insight into actual requirements is through the taxonomy compass. This tool allows anyone to look at the requirements and criteria per sector or per activity. Even with this compass, identifying all the right indicators and subsequently measuring, organizing, and reporting on them can be a monumental task for your company. At Intire, we understand how to tackle all the details involved. We can help streamline this process by guiding you to the right indicators for your company, providing you with the tools you need to measure and monitor data, and implementing a solution that lets you transparently report both internally and externally.

Prepare in time

The new guideline is arriving soon, and its impact is sure to be felt for companies across the European Union. Start preparing now to make sure you know where your company stands and avoid unpleasant surprises. By reporting on and aligning yourself with the EU Taxonomy, you ensure that your company remains appealing to customers, (future) employees, and investors alike.

Valentijn Veurtjes, Sustainability Consultant Intire