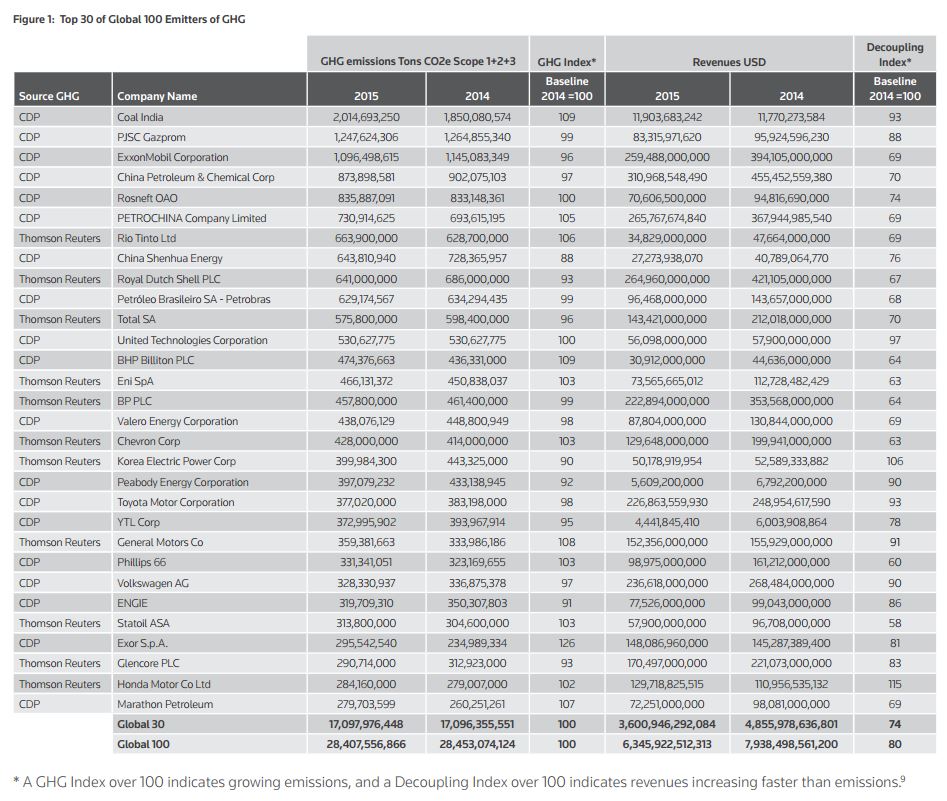

Thomson Reuters today released its report, Global 100 Greenhouse Gas Performance: New Pathways for Growth and Leadership. The report reveals not only the latest greenhouse gas (GHG) emissions data from the world’s 100 largest publicly traded emitters (Global 100) but the pathways these companies have for emissions reduction and earnings growth. This information is critical as analysts and investors consider long term financial performance and as regulators continue pressing for increased transparency. The report was written in collaboration with CDP, a global non-profit specializing in carbon disclosure, and BSD Consulting, a global sustainability consultancy, with key contributions from Baker McKenzie, KPMG and State Street Global Exchange.

Tim Nixon, Head of Sustainability Thought Leadership, Corporate Responsibility & Inclusion at Thomson Reuters, and co-author for the report commented, “A significant finding of this report is there is an increasing correlation between sustainability and growth. Committing to rigorous decarbonization will not adversely impact financial gain and will positively increase shareholder value over the long term. This argument is critical to ensuring that the Global 100 remain committed to operating responsibly.”

Erik Solheim, head of UN Environment shared, “The message we hear from the private sector is that going green is good for business, and transparency is a crucial part of this shift. The markets are moving rapidly, and the private sector is where some of the most exciting low-carbon innovations are taking place. This is essential if we are to meet the goals of the Paris Agreement, and close the emissions gap.”

The Global 100 currently contribute a significant portion of worldwide emissions annually. Any significant progress will require their buy-in. This report specifically explores:

- The most current publicly available emissions data from the Global 100

- New data on emissions from value or supply chains from the Global 100

- Key pathways to decarbonization for the Global 100

- The impact of shareholders and investors on this trend

- The impact for companies as investors begin to reward carbon-intensive companies for developing and executing decarbonization plans.

Lance Pierce, President of CDP North America, commented, “What’s powerful about this report is that it not only clearly articulates the problem posed by high emitting companies, it also highlights what the leaders are doing to innovate, and a pathway to success whether you are an investor or a corporation. At CDP we are delighted to partner with Thomson Reuters in helping show how the “Sustainability Premium” is real, and to pull back the curtain on the trend toward how the businesses of the future will be managing themselves.

Patsy Doerr, Global Head of Corporate Responsibility & Inclusion, commented, “Our clients increasingly see ESG data and trends as important for their work across the investing, tax & accounting, and legal marketplaces. This report is another milestone for professional risk managers globally who can and do influence the direction of the global economy.”

In collaboration with CDP, data for the report was gathered from publicly available GHG emissions data from businesses and from estimates either from CDP or Thomson Reuters environmental, social and corporate governance (ESG) research data. Thomson Reuters ESG research data gathers standardized, objective, quantitative and qualitative ESG data from an estimated 5,000 publicly listed companies.

View the full report here (pdf)