Minderoo Foundation’s groundbreaking Plastic Waste Makers Index (PWMI) 2023 shows the planet’s plastic pollution problem is worsening, and new estimates of lifecycle greenhouse gas emissions from single-use plastics demonstrate how single-use plastics producers also contribute to the climate crisis.

The report’s key findings reveal:

- Despite rising consumer awareness, corporate attention, and regulation, there is more single-use plastic waste than ever before – an additional 6 million metric tons (equivalent to almost 1 kg per person on the planet) generated in 2021 compared to 2019 – still almost entirely made from fossil fuels.

- Single-use plastic is not only a pollution crisis but a climate one. Lifecycle greenhouse gas (Scope 1, 2 and 3) emissions from single-use plastics in 2021 were equivalent to the total emissions of the United Kingdom (450 million metric tons CO₂e).

- Recycling is failing to scale fast enough and remains a marginal activity for the plastics sector – from 2019 to 2021, growth in single-use plastics made from fossil fuels was 15 times that from recycled plastics. Only decisive regulatory intervention can solve what amounts to market failure in scaling up recycling.

- Within the petrochemical industry, two outliers are firmly committed to recycling and producing recycled polymers at scale: Taiwan’s Far Eastern New Century and Thailand’s Indorama Ventures.

The Plastic Waste Makers Index 2023 brings the benchmark up to date with data to the end of 2021 (the first edition covered 2019). It discovered that the global population used 139 MMT (million metric tons) of single-use plastic in 2021, up from 133 MMT in 2019.

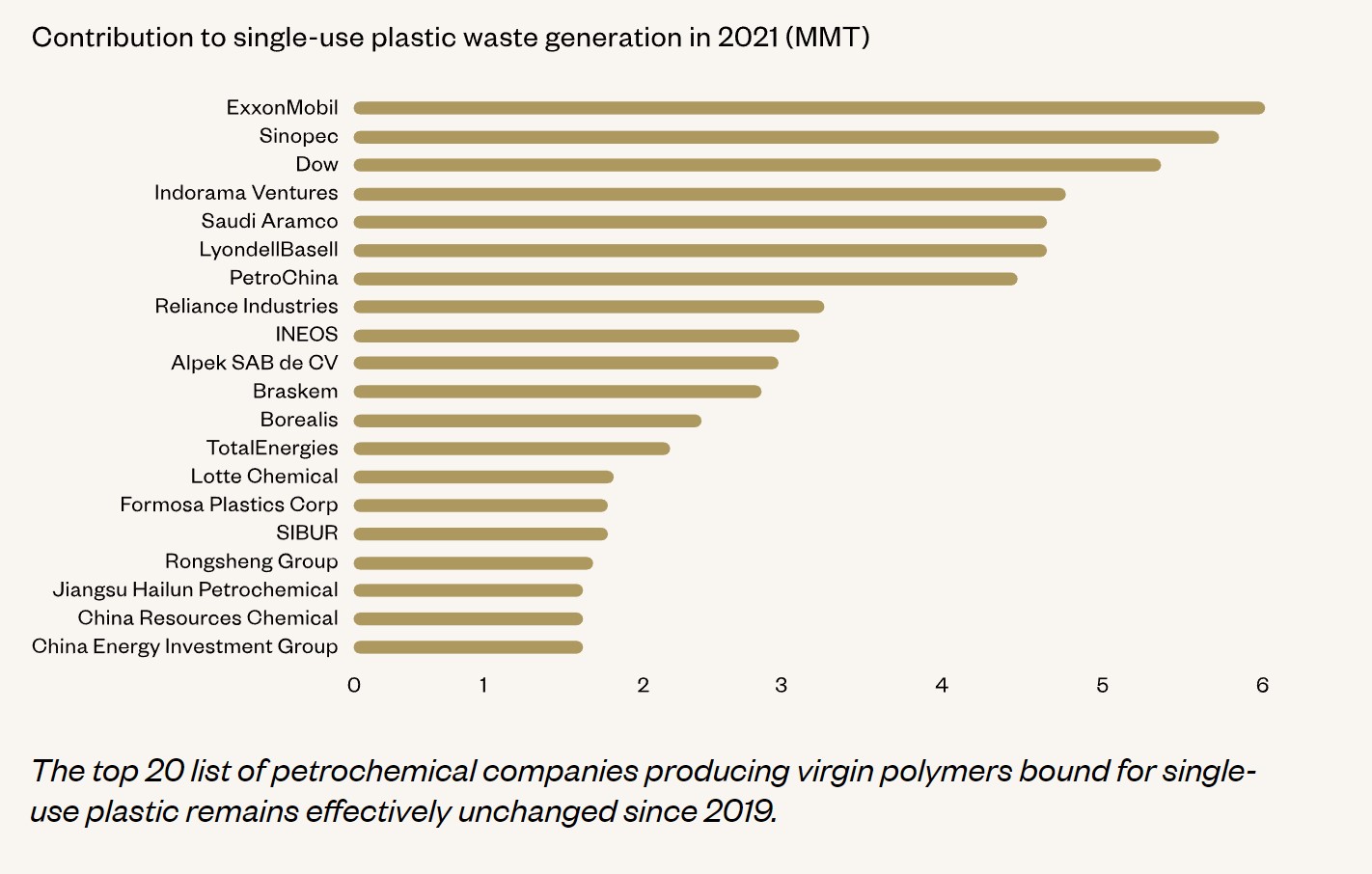

The composition of the top 20 petrochemical companies with the largest plastic waste footprint is strikingly similar to the first PWMI. U.S.-based ExxonMobil remains the largest producer of polymers bound for single-use plastics – responsible for 6.0 MMT alone in 2021 – followed by China’s Sinopec (5.8 MMT) and U.S.-based Dow third (5.3 MMT).

Dr Andrew Forrest AO, Chairman of Minderoo Foundation, said: “More plastic, more waste and more pollution. The fossil-fuel giants aren’t tackling the problem of plastics – it’s the opposite, they’re making even more of a product that threatens our people and planet. For the petrochemical industry to argue otherwise is green washing of the highest order.

“We need a fundamentally different approach that turns the tap off on new plastic production. We need a ‘polymer premium’ on every kilogram of plastic polymer made from fossil fuel. We need financial incentives that encourage re-use and recycling and the build of new, critical infrastructure.

“If you’re investing in polymer producers right now when there isn’t a polymer premium in place, then your hands are covered in the blood of the destruction of nature.”

Among the report’s key recommendations is a stark call for investors and financial institutions to use engagement, proxy voting and divestment strategies to pressure petrochemical companies building new fossil fuel-based polymer production facilities.

“This comprehensive report provides a useful benchmark for embarking on plastic and climate-related research and shareholder engagement efforts,” said Casey Clark, President and Chief Investment Officer of Rockefeller Asset Management. “Investors, regulatory bodies, and civil society have emphasised the need to reduce plastic consumption, increase waste management efforts, and transition to ‘circular’ modes of living. Even with that backdrop, the global intake of raw virgin materials and single-use plastics continues to rise.”

Mr Clark added: “In the second edition of the Plastic Waste Makers Index, the Minderoo Foundation, alongside research partners, highlights the critical linkages between plastics and net-zero carbon emission goals.”

The biggest emitters of greenhouse gases associated with single-use plastics are also the biggest producers of polymers. According to the data analysed by Carbon Trust and Wood Mackenzie, the greenhouse gas emissions from single-use plastics were equivalent to approximately 450 million metric tons of carbon dioxide, more than the total GHG emissions of the United Kingdom.

The Index finds that despite recycling offering a solution for both the climate and waste crises – when compared to making polymers from fossil fuels, making them from (mechanically) recycled plastic waste could also displace at least half of the greenhouse gas emissions – recycling is failing to scale at a rate required to reduce reliance on fossil fuel plastics. From 2019 to 2021, growth in the mass of single-use plastics from virgin polymer outpaced that from recycled feedstocks by a factor of fifteen to one (6 MMT versus 0.4 MMT).

KPMG provided limited assurance on the analysis in the report, which offers some cautious hope for the petrochemical industry to play a role in the transition away from a fossil fuel-based plastic economy. Taiwan’s Far Eastern New Century and Thailand’s Indorama Ventures have made substantial pledges to increase their recycling efforts and already make high-quality recycled polymers at an industrial scale.

Dominic Charles, co-author of the Index, is encouraged by the advancements made by the industry’s trendsetters but said this shouldn’t detract from the magnitude of the task ahead for the bulk of polymer producers. “Looking back over the two years since we first shone a spotlight on the source of the single-use plastics crisis, it’s concerning that a greater number of the Top 50 polymer producers have not achieved higher circularity scores. While our research provides the evidence needed by legislators to develop meaningful industry regulation on a global scale, it should also guide corporations on the need for a greater level of transparency on their plastics circularity ambitions and actions,” Mr Charles said.

The research also examines how the circularity scores shape up against the public claims made by the top 20 polymer producers. Saudi Aramco, Borealis, Dow and Braskem stand out in terms of the mismatch between their high frequency of public claims about plastics circularity and their actual circularity credentials.