In line with its commitment to sustainability, Repsol aims to achieve net zero emissions by 2050, making it the first oil and gas company in the world to assume this ambitious goal. At the same time, it is setting a decarbonization path with intermediate targets for 2020 to 2040.

This ambition entails directing all of its activities and investments to meeting new and more stringent plans all in alignment with the energy transition and the effort to limit the planet’s temperature rise to well below 2 degrees Celsius according to the Paris Agreement’s climate goals.

In this context, the company assumes a new oil and gas price scenario consistent with the Paris Agreement’s climate goals. This adjustment to the value of some assets implies a post-tax impairment charge of 4.8 billion euros, which will be reflected in specific results for 2019 but will neither affect cash flow nor shareholder remuneration, which is among the most attractive in the Spanish stock market and in the sector worldwide.

The Upstream unit will prioritize the generation of value and cash over volume. The industrial businesses will maintain its current leading profitability and add more stringent decarbonization goals as well as an increase in the production of biofuels and chemical products with a low carbon footprint. The new businesses will expand their low-carbon electricity generation targets through 2025.

The company’s 2021-2025 Strategic Plan, which will be presented to the market and investors in the first half of 2020, will be based on this new, and more demanding scenario.

Repsol’s Board of Directors has analyzed the role of the company in the fight against climate change and took a new step in its commitment to leading the energy transition in line with the objectives of the Paris Agreement and the Sustainable Development Goals of the United Nations.

Repsol’s Board of Directors has analyzed the role of the company in the fight against climate change and took a new step in its commitment to leading the energy transition in line with the objectives of the Paris Agreement and the Sustainable Development Goals of the United Nations.

Accordingly, Repsol will direct its strategy towards achieving net zero emissions by 2050. The company is the first in its industry to set this ambitious goal, which aims to limit planetary warming to less than 2 degrees centigrade compared with pre-industrial levels.

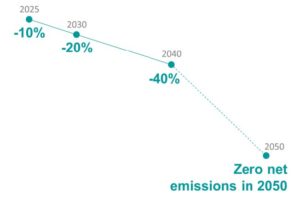

To achieve this objective, Repsol is setting new goals for the reduction of its carbon intensity indicator from a 2016 baseline: 10% by 2025, 20% by 2030, 40% by 2040, and net zero CO2 emissions by 2050. It is possible to achieve at least 70% of this target with the technology that can currently be foreseen, and the company is committed to applying the best available technologies to increase this figure, including carbon capture, use and storage. Repsol would, if necessary, aditionally offset emissions through reforestation and other natural climate sinks to achieve zero net emissions by 2050.

These figures will form the basis for the 2021-2025 Strategic Plan, which will be presented to the market and investors in the first half of 2020.

The new strategic focus in the context of new dynamics in the oil and gas markets and in policies that target decarbonization of the economy, Repsol has revised the valuation hypotheses for investments assuming a scenario compatible with the climate goals of the Paris Agreement and the United Nations.

As a consequence of the application of this new scenario Repsol expects to adjust the accounting value of some assets, with a post-tax accounting charge of approximately 4.8 billion euros. This adjustment will reduce specific reported income for 2019 but does not alter the company’s cash flow for the year nor the announced proposal to increase shareholder remuneration.

Cash flow from operations in 2019, which increased 22% in the nine months to September compared to the same period of 2018, will allow the company to achieve shareholder remuneration of one euro per share, formulate the proposal to the next Annual General Shareholders’ Meeting to buy back 5% of the outstanding share capital (in addition to the redemptions of the shares issued in the flexible dividend programs), and consider further stock buy-backs when cash surpluses are not applied in the short term to investment opportunities with the requisite return. Repsol’s remuneration policy is among the most attractive of the Spanish stock market and of its sector worldwide.

“We are convinced that we must set more ambitious objectives to fight climate change. We believe now it is the right time for Repsol. We do it with the utmost confidence that we invest for the future. Addressing the significant challenges that lie ahead with strategic clarity is what will allow us to turn them into opportunities. We are convinced that this strengthens our project that is sustainable, attractive and profitable for all our stakeholders” said Chief Executive Officer Josu Jon Imaz.

Business strategy

Repsol’s determination and strategic clarity in its progress towards decarbonization are demonstrated by the development of projects associated with the energy transition. In this sense, the company is increasing by 3,000 MW its target for low-carbon electricity generation capacity, to 7,500 MW by 2025, and will begin to expand into other markets to become a leading international player in renewable energies.

Repsol currently has 2,952 MW in operation and 1,083 MW under development, and the Board of Directors has approved new investments to incorporate and build two photovoltaic and one wind power projects totaling an additional 1,600 MW. With these projects, the renewable power portfolio reaches a total capacity of 5,600 MW.

In the Upstream business, Repsol will orient its asset portfolio towards compliance with the Paris Agreement to achieve the planned goals. This will entail prioritizing value generation over production growth, whilst maintaining flexibility as the strategic axis of the business, placing the emphasis on rotation and improvement of the asset portfolio and on cash generation.

This vision translates to a strategy of balancing gas and oil reserves, with a vision of gas as the fuel for the energy transition while also taking into account the active role that oil must play in a more decarbonized world.

For the assessment of future exploration or production decisions, the company is assuming an oil and gas price curve compatible with the Paris Agreement and the scenario of limiting the temperature increase to well below 2 degrees Celsius.

In its industrial business, with a primary focus on refining, Repsol is raising its decarbonization target, with an additional direct emissions reduction of 25% by 2025. This reduction is on top of the 23% cut in CO2 emissions achieved between 2010 and 2017.

Repsol will focus on the circular economy as a tool for the efficient use of resources and will double the production of high-quality biofuels derived from vegetable oils (HVO) to 600,000 tons per year in 2030, half of which will be derived from waste transformation before 2025.

Repsol will also integrate renewable energy into refining operations, which will incorporate production of green hydrogen as well as the use of renewable energy to fuel industrial processes.

The company’s chemicals business will also contribute decisively to a more decarbonized economy. In its industrial process, Repsol is committed to a business that is efficient and oriented towards the circular economy, with the ambition of achieving a 20% recycled content in its total polyolefin output by 2030.

Petrochemical products, present in most activities in our daily life, play a major role in achieving a lower carbon intensity scenario. Their advantages and applications include, among others, a reduction in the weight of materials that contributes to lower energy consumption in mobility, insulation for homes and buildings, which contribute to greater energy efficiency, an improvement in food conservation conditions and advanced products for medical and sanitary use. Consequently, global demand for petrochemical products is expected to increase by 30% to 2030 and 40% to 2050.

Repsol will continue developing its client-centric multienergy strategy, offering multiple solutions, and differentiated service and digitalization services to improve daily management.

The company’s service stations will continue to expand the offering of electric charging points, liquid petroleum gas, compressed natural gas and liquefied natural gas, and will continue to complement its electricity offering with high-value services, such as domestic renewable power, aligned with the decarbonization pathway.

Investments and CO2 pricing

Alignment with the objectives of the Paris Agreement and the commitment to decarbonization has an overall impact on the company’s management criteria and processes, on the strategies of the businesses, and on the evaluation of investments.

For the latter, Repsol will analyze alignment with the Paris Agreement in each of its investments. Accordingly, each major investment will be accompanied by a report from the Sustainability unit to ensure this alignment.

Repsol has also updated the internal CO2 price deck that will guide its investments, starting at $25/t in 2018, with an increase of up to $40/t by 2025. Additional growth is also being established from that year, to $70/t by 2040 for refining, chemicals and gas and electricity assets, which will favor investments in renewable energy, efficiency and the circular economy.

To reinforce the organization’s commitment to these goals, Repsol will link at least 40% of the long-term variable pay of its managers and leaders, including that of the CEO and senior executives, to objectives that lead the company to comply with the Paris Agreement and, therefore, its progressive decarbonization.

Track record on climate change

Repsol’s commitment to sustainability has been constant over the past 25 years. It was the first company in the industry to support the Kyoto Protocol, and it is now intensifying its decarbonization ambitions with the aim of being a net zero emissions company by 2050.

The creation of an internal Carbon Intensity indicator, coinciding with the updating of the 2018-2020 Strategic Plan, allowed the company to set emissions-reduction targets to reduce this indicator by 40% by 2040 with respect to 2016. Thus, Repsol advanced in its strategic alignment with the Paris Agreement and the goal of limiting the temperature increase to well below 2ºC compared with pre-industrial levels. This decision was recognized by socially responsible investors, who regard the company as a leader in its sector in the fight against climate change. ESG (Environmental, Social and Governance) investors own 15% of the company’s total shares and represent 30% of its institutional investors.

In 2019, Transition Pathway Initiative (TPI), an association that brings together 50 of the largest global investors, managing assets of over 15 trillion dollars, recognized Repsol as one of the only two companies in its sector in the world with a strategy compatible with the objectives of the Paris Agreement.

Repsol works with investors to strengthen the alignment of its position on climate change with the Paris Agreement. As a result of this engagement, the Climate Action 100+ initiative, which groups over 370 international investors managing over 35 trillion dollars, recently recognized the company’s efforts in this area.

Standard & Poor’s has ranked Repsol among the companies in its industry with the most advanced sustainability strategy and made a very positive assessment of the diversification of its businesses and its firm commitment to the Paris Agreement.

In addition, the company has pledged to work so that all the associations and initiatives in which it participates are in alignment with the targets derived from the Paris Agreement.

In 2020, Repsol will publish a report with an analysis of this alignment in all the associations and initiatives in which it participates, terminating its involvement with any whose actions or messages are incompatible with the fight against climate change.