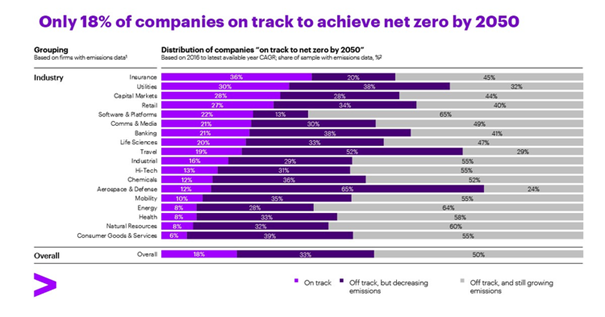

Fewer than one in five companies (18%) are currently on track to reach net zero emissions in their operations by 2050, and over a third (38%) say they cannot make further investments in decarbonization in the current economic environment, according to new research from Accenture. However, industry leaders can break this economic stalemate within only three years by reinventing decarbonization strategies that enable growth for energy-intensive, hard-to-abate heavy industry—such as steel, metals and mining, cement, chemicals and freight and logistics—the operations of which generate 40% of total global CO2 emissions.

Released ahead of the 28th UN Climate Change Conference of the Parties (COP28), the research analyzes net zero commitments, decarbonization activities and emissions data for the 2,000 largest companies globally. Additional primary research includes a survey of more than 1,000 executives across 14 industries and 16 countries to understand the near-term challenges and priorities of industrial decarbonization.

Accenture’s analysis in Destination net zero found the number of companies that have set targets for net zero has risen to 37%, up from 34% last year. Despite reason for tempered optimism, half (49.6%) of the companies that disclose emissions data have presided over increasing emissions since 2016. One-third (32.5%) are cutting emissions, but on current observable trends are not on track to reach net-zero in their operations by 2050. To address the issue at an enterprise level, the report identifies a broad set of decarbonization levers that enable and accelerate progress. These range from well-established actions, such as improving energy efficiency and switching to renewables, to more complex measures, such as the implementation of green IT, the reinvention of business models and carbon removal.

“It’s promising to see an increase in public commitments to net zero targets again this year, but the adoption of key decarbonization measures is not uniform, with some companies still unable to master the basics,” said Jean-Marc Ollagnier, CEO of Accenture for Europe, Middle East and Africa. “Reaching net zero is a unique opportunity for every organization to reinvent themselves and their value chains by aligning business growth with the net zero imperative, despite the many obstacles they must overcome. However, it is not just an enterprise challenge but also an ecosystem one, as there is a need to address the disconnect between supply and demand.”

When surveying leaders for the Powered for change report, Accenture found that heavy industry reinvention is critical to achieving all global net zero targets—both as the world’s biggest emitters and due to their interdependence with manufacturing, or “light” industry, which includes pulp and paper, aerospace and defense, automotive, industrial equipment, life sciences and consumer goods. However, economics of decarbonization and structural misalignment between industries are at the core of what’s constraining progress:

- Improved access and availability to affordable, low-carbon energy is required: Four out of five (81%) leaders from heavy industry expect to need more than 20 years to have sufficient zero-carbon electricity to decarbonize their industry, with energy providers primarily focused on decarbonizing their own operations.

- There is a need to bolster confidence in the commercial viability of low-carbon products: 95% of heavy industry leaders expect to need at least 20 years to deliver net zero products or services at or close to price parity with high-carbon alternatives, and just over half (54%) say that manufacturers’ future purchasing intentions give them enough confidence to invest in decarbonization.

- Concerns about managing the costs must be addressed: Two in five (40%) leaders in heavy sectors said they can’t afford further investment in decarbonization in the current economic climate, with 63% suggesting their priority decarbonization measures won’t be economically attractive before 2030.

“The rapid, affordable decarbonization of heavy industry requires collective action across the value chain and urgently compressed transformation. We believe this can break the economic stalemate by inspiring new levels of growth and help accelerate net zero in just three years of focus,” said Stephanie Jamison, global resources industry practice lead and global sustainability services lead at Accenture. “If heavy industry is burdened with the full cost of decarbonization and fails to meet net zero targets, all industries will fail.”

Most organizations use a three-year strategic planning cycle, and while three years will not be enough to fully achieve net zero for most, the report lays out what must be accomplished during this crucial timeframe to eliminate the economic growth trade-offs and advance net zero. To build this foundation, three key steps must be taken within the next three years for viable decarbonization pathways that simultaneously pull on as many decarbonization levers as possible:

- Target green premiums to finance the first phase of industrial decarbonization: Light industry must lead in this initiative. Absorbing upfront costs of decarbonization and knowing which green products to target are key to unlocking future savings. In fact, 52% of executives in heavy sectors view revenue growth as the primary path to improving the economic business case for the top three decarbonization priorities.

- Scale low-carbon power and hydrogen more quickly to guarantee affordable, secure supply: Accenture projects the levelized costs of solar power and green hydrogen could fall by 77% and 74% by 2050, respectively, if their potential is optimized, ultimately reducing green industrial products’ costs. Additionally, almost two-thirds (64%) of oil, gas and power companies believe their industrial and logistics customers are willing to enter long-term decarbonization partnerships, collaborating to initiate a virtuous circle.

- Drive down the capital and operating expense related to low carbon infrastructure: It is essential that cost reductions, which are mostly in the control of heavy industry, are fully realized to drive their decarbonization. For example, based on our analysis, there is significant cost reduction potential (49% by 2050) in green steel, with reduction in construction and equipment costs a key lever.

Jamison added: “To provide the business growth that is necessary to put net zero back within reach, these imperatives must be executed in parallel and scaled to meet the moment, starting right now. Stakeholders around the world—across industries and governments—must come together to create a new frontier for the economics of decarbonization, giving heavy industry a firm foundation for reinvention.”

Research Methodology

For Destination net zero, Accenture worked with The SmartCube to collect data on the G2000 across a given set of criteria relating to decarbonization. This research, now in its third year, involved manual inspection of company public documentation (e.g., websites, annual reports and sustainability reports). The approach allowed Accenture to construct a proprietary database of the decarbonization targets and levers adopted by companies in the G2000. Emissions data were retrieved from S&P Global Market Intelligence, Sustainable1.

For Powered for change, Accenture fielded in April/May 2023 a global survey with 1,000 executives at C-level or C-minus-1 across oil, gas and power sectors, heavy industry and light industry. The survey focused on near-term challenges and priorities of industrial decarbonization, expectations for Scopes 1 to 3 emissions, and key revenue and cost levers for improving the financial business case for selected decarbonization solutions. In parallel, Accenture ran a series of qualitative interviews and techno-economic modeling that employed Accenture’s proprietary S-curve analysis to quantify cost drivers for selected decarbonization pathways in selected scenarios.