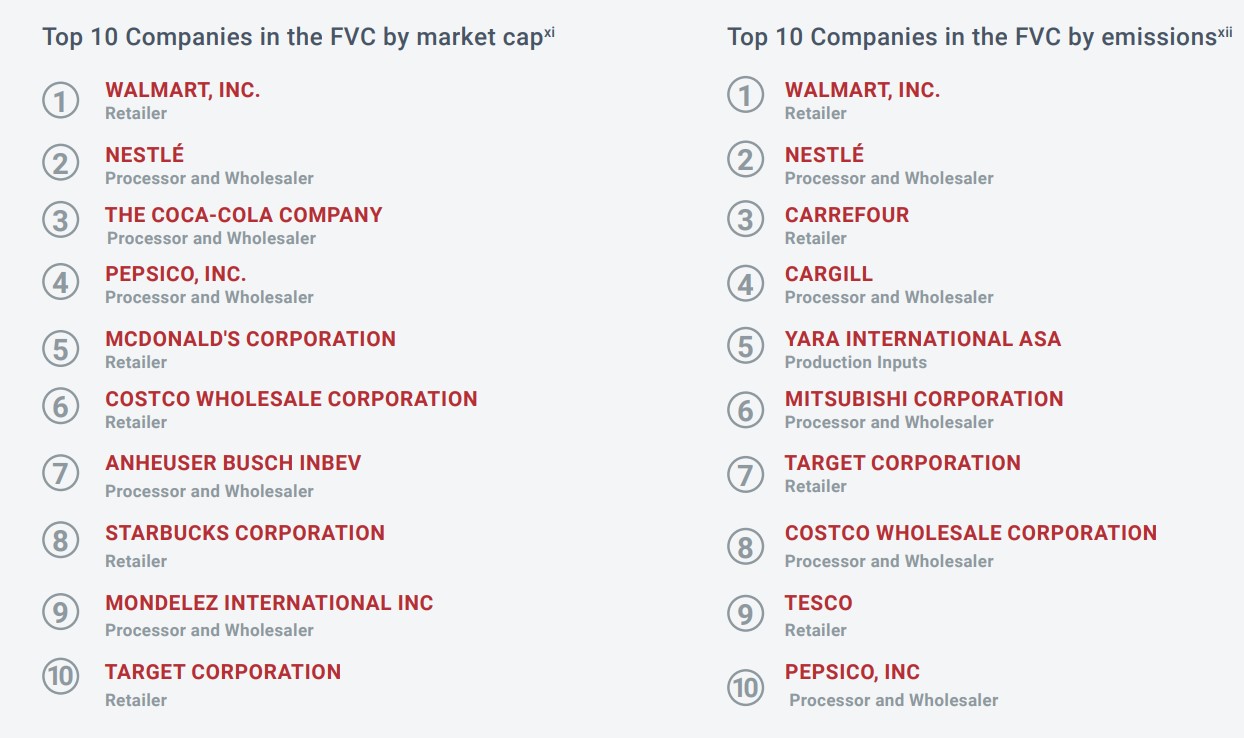

Leading companies operating in the global food value chain are underestimating key environmental risks and ignoring opportunities for creating a more sustainable food system, according to a new report published today by global environmental non-profit CDP. The report, “Hungry for change,” analyzes the environmental disclosures of 504 companies involved in the production, processing and sale of food products – including the likes of Walmart, Nestlé, Pepsi and Target. The analysis takes a comprehensive look at the entirety of the value chain of the global food system, from producers and purchasers, to processers and manufacturers, to retailers. It analyzes the companies’ environmental risks, impacts and future opportunities through the lens of the interlinked issues of climate change, deforestation and water security.

The analysis finds that food companies are responding to growing consumer demand for healthy and sustainable products by producing more foods made from plant proteins (as opposed to GHG emissions-intensive beef and other animal proteins). One third of all business opportunities disclosed to CDP are related to new products & services, such as offering vegan options.

However, the report warns that companies are not sufficiently building resilience against drought and other risks. The analysis suggests that companies see more opportunity in “green” products than in true resilience-building – a potentially grave misstep in a warming world that sees more frequent extreme weather patterns each year, which in turn make it harder to grow ample and nutritious food.

Disclosure is the first step to managing impacts and risks. Encouragingly, of the food value chain companies requested to disclose their climate change impact through CDP in 2019, 70% did so – compared with 67% of non-food companies. Retail companies are the least transparent (38% of those requested disclosed), while processing & wholesaling companies are the most transparent (78% of those requested disclosed). Disclosure on forests lags – just 18% of food retailers and 28% of primary food producers who were requested disclosed in 2019.

One encouraging sign is the year-on-year increase in food value chain companies setting ambitious decarbonization targets (75 companies have committed to or have set science-based targets, which is 16% of the full sample).

However, the report argues that limiting global warming to 1.5°C will not be possible without a rapid transformation of the global food system and all players in the value chain will be required to move away from business as usual. This requires a transition to more plant-rich diets, increased agricultural productivity while protecting and restoring natural ecosystems, increased adoption of nature-based solutions and significantly reduced food loss and waste. In their CDP disclosures, food value chain companies themselves report significant barriers they must still overcome to create a sustainable food system.

“Food is a critical environmental, social and economic issue that impacts us all,” says Bridget Schrempf, Manager, Sustainable Food Systems at CDP. “As the demand for food has grown, so has the resulting surge in emissions, loss of natural ecosystems and forests, increasing water scarcity and pollution and declining biodiversity. But a better future is possible. Companies have a remarkable opportunity to build a just, fair and sustainable food system that meets the needs of the world’s population without exceeding our planetary boundaries.”

In a value chain where the impacts originate and are felt primarily at the production level, it is essential that companies both monitor and fully engage with their value chains – but such engagement is lacking. Only 16% of companies disclosing on climate change engage with all levels of the value chain.

Food value chain companies that disclosed on climate change, water security and forests were more than twice as likely to identify substantive risks like drought, flood and other extreme weather than non-food companies — 38% compared to 16%.

Meanwhile, food value chain companies are underutilizing internal carbon and water pricing – despite growing consensus that internal pricing is the most flexible, cost-effective approach to mitigating climate change and water insecurity. Only 28% of food value chain companies are using or planning to use an internal price on carbon within the next two years (compared to 35% of all disclosing non-food companies), and only half are using an internal water price or plan to implement one (compared to 35% of all disclosing companies).

The report finds that existing market mechanisms are not sufficient to support and incentivize the transformation of the global food sector into a sustainable system. Effective, concrete policy is needed.

COVID-19 has demonstrated that shocks to the economy can have real implications for the global food system. Companies can get ahead of potential future disruptions – including those caused by infectious disease and other environmental risks – by engaging and incentivizing action within their value chains, conducting scenario and risk analyses, setting targets and building resiliency.

The analysis is the first output produced by CDP’s newly launched Sustainable Food Systems Initiative, which aims to shine a light on the key role of agriculture and food sectors in the environmental crisis.