Investing in product safety, employee diversity and carbon footprint reduction are all examples of corporate social responsibility (CSR) that can result in high praise for a chief executive — or get them fired — according to new research from the University of Notre Dame.

“Higher Highs and Lower Lows: The Role of Corporate Social Responsibility in CEO Dismissal” is published in the current issue of Strategic Management Journal by Tim Hubbard, assistant professor of management in Notre Dame’s Mendoza College of Business, Dane Christensen of the University of Oregon and Scott Graffin from the University of Georgia. The study found that when CEOs choose to invest in CSR, it changes the likelihood they will be fired based on the firm’s financial returns.

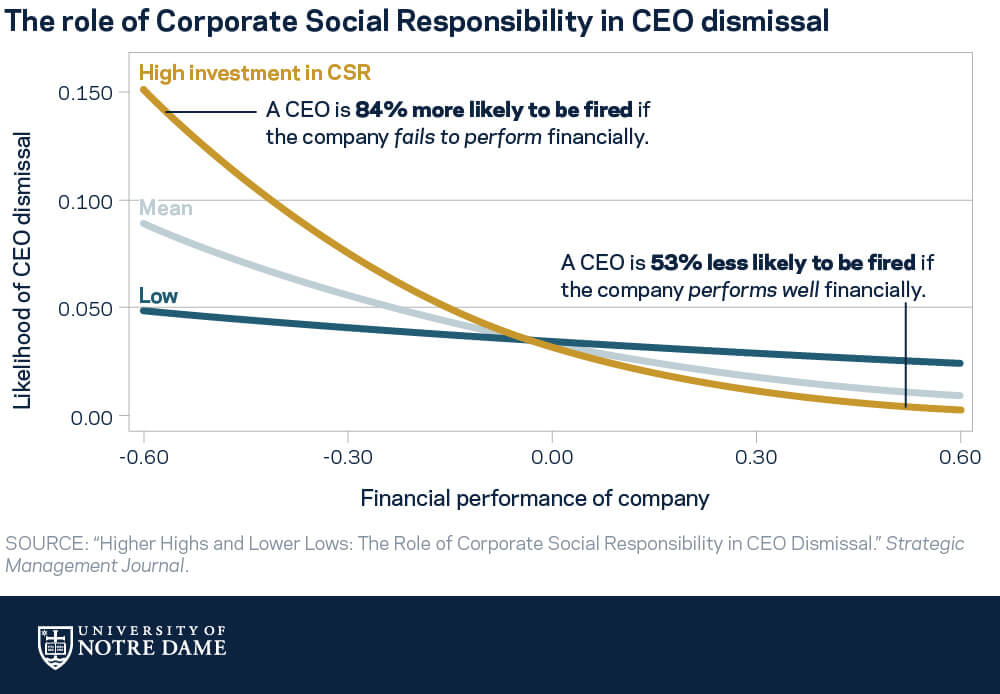

“If a CEO has invested in CSR and the firm performs poorly, they are much more likely to be dismissed,” Hubbard says. “On the other hand, if they have invested in CSR and the firm performs well, they are less likely to be fired. This shows that CSR investments can be a double-edged sword — do well and they’ll buffer you from dismissal, do poorly and you’re more likely lose your job.”

The research shows that the effects of a CEO’s past investments in CSR are substantial and can linger.

“CEOs running firms with higher levels of CSR are 84 percent more likely to be dismissed when financial performance is poor, compared to their counterparts at firms with lower levels of CSR, Hubbard says. “However, research also indicates that prior CSR investments reduce a CEO’s likelihood of dismissal by 53 percent when profits are higher.”

The researchers examined all CEO transitions in the Fortune 500 from 2003 to 2008 to assess whether or not they were voluntary or the CEO was fired. They looked at each firm’s prior corporate social activities based on third-party assessments and their financial performance, then assessed how CSR and financial returns work together to lead to CEO dismissal.

Consequently, stakeholders interested in seeing a CSR uptick, should understand CEOs make such investments at great personal risk.“It’s important for us to understand the personal consequences CEOs face when investing in CSR,” Hubbard says. “Investments in CSR continue to rise and they are becoming an integral part of modern corporations. At the same time, these highly visible investments are not always profitable. Indeed, studies have not been conclusive on whether there is a clear link between CSR investments and profitability. This leads these highly visible decisions to be scrutinized and contested.”

“The purpose of a company is to produce a profit, but it’s also becoming well accepted that this should be accomplished in a socially responsible manner,” Hubbard says. “If shareholders and boards expect CEOs to take these actions, they may need to consider incentives and compensation schemes that protect them in some way. That would help the CEO to be more comfortable making these contentious, highly scrutinized investments.”

Specializing in behavioral strategy, Hubbard teaches strategic management. His research focuses on the social and cognitive factors that influence behavior, examining CEO dismissals, personality, reputations, status and celebrity, performance, compensation and political orientation of CEOs.

Prior to entering academia, Hubbard worked in a number of positions for Caterpillar and as a senior strategy consultant for IBM, where his clients included General Motors, Visteon, DuPont and Royal Dutch Shell.